If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax (WEG) label, you need further information to claim GST credits and for it to be considered a valid tax invoice.

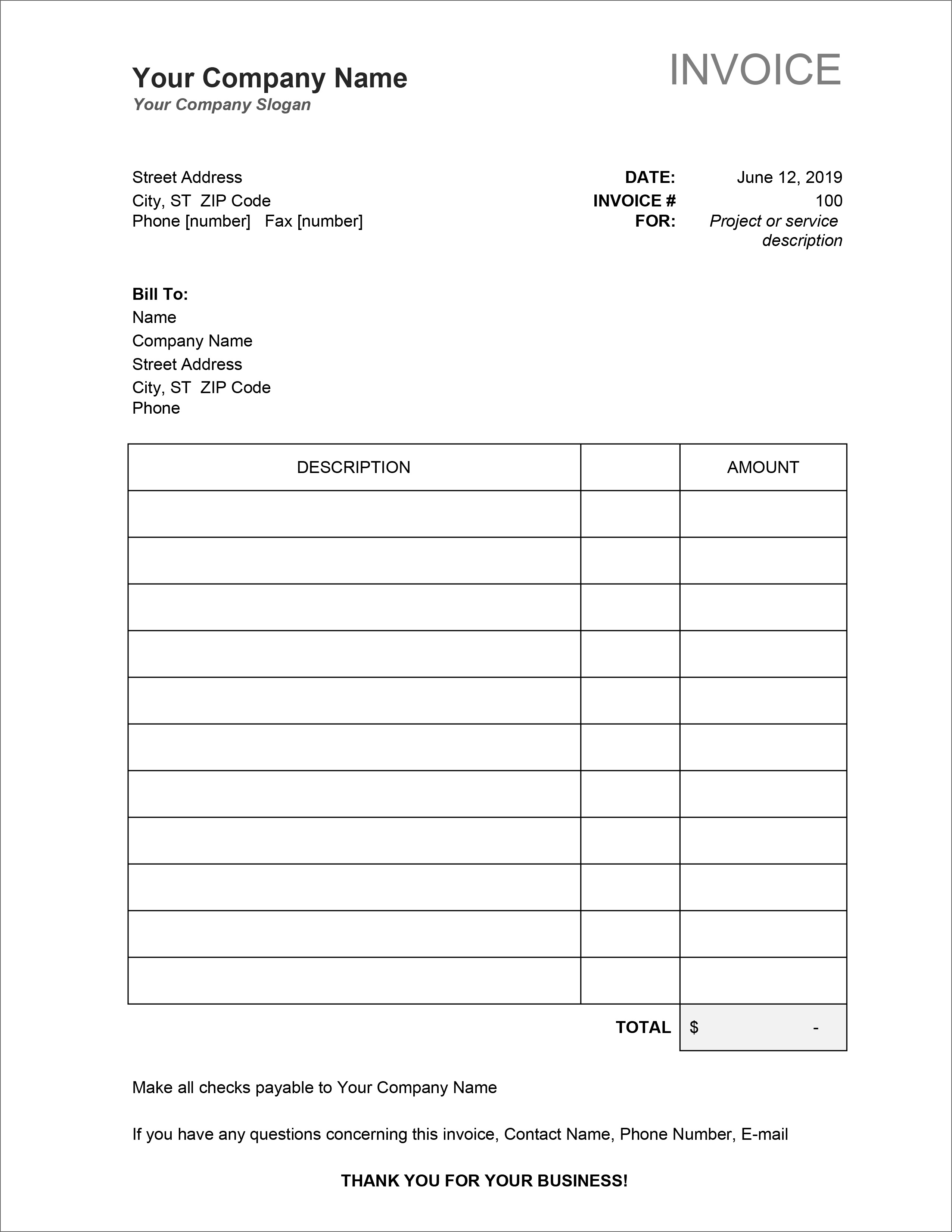

document is intended to be a tax invoice.

Tax invoices for taxable sales of less than $1,000 must include enough information to clearly determine the following 7 details: the sale type (for example, a sale that includes both taxable and non-taxable items).The information a tax invoice must include depends on: If a customer asks for a tax invoice, you must provide one within 28 days, unless it is for a sale of $82.50 (including GST) or less. Explains when to provide a tax invoice, what it must include and dealing with non-taxable sales and rounding.

0 kommentar(er)

0 kommentar(er)